Smart Contracts and Their Impact on Traditional Banking Systems

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are transforming various sectors, including traditional banking systems. These innovative technologies offer enhanced financial transparency, streamlined processes, and potential disruptions to conventional banking practices. This article explores the impact of smart contracts on traditional banking systems, including their role in financial transparency, loan processing automation, and the adaptation of banking practices.

Smart Contracts and Financial Transparency

- Enhanced Transparency

- Immutable Records: Smart contracts create immutable records of transactions, which are stored on a blockchain. This ensures that all transaction details are permanently recorded and cannot be altered, providing a transparent and verifiable audit trail.

- Real-Time Monitoring: Blockchain technology allows for real-time tracking of transactions and contract execution, enhancing visibility and reducing the potential for fraud or discrepancies.

- Reduced Need for Intermediaries

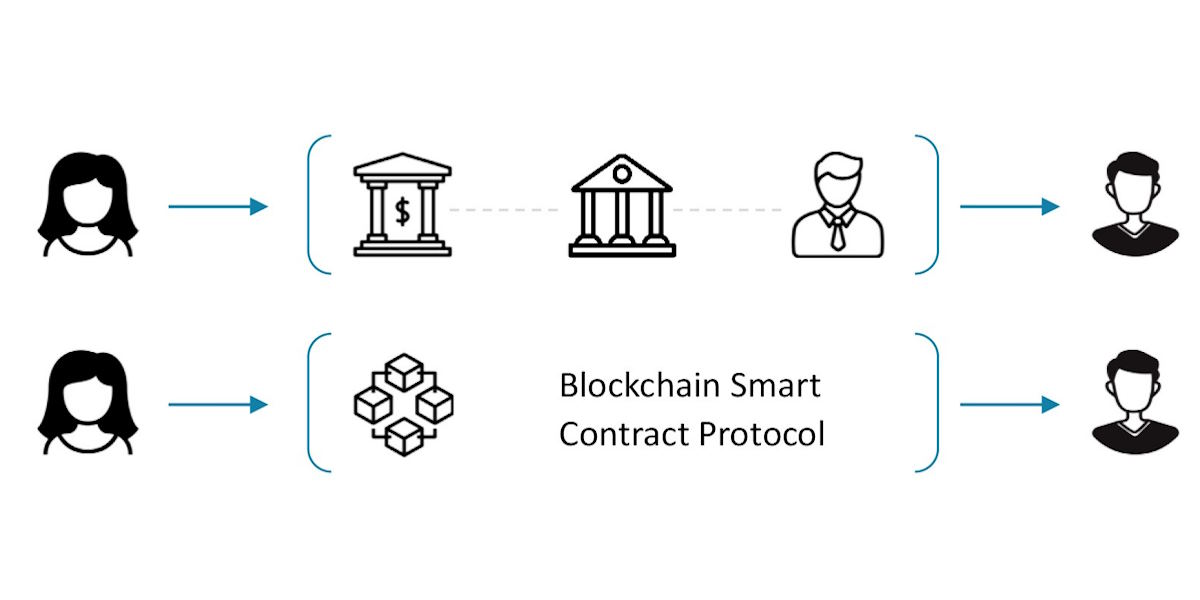

- Direct Transactions: By automating contract execution, smart contracts reduce the need for intermediaries such as brokers or notaries. This minimizes the potential for errors and lowers transaction costs.

- Efficient Settlements: With automated processes, transactions are executed faster, reducing the time required for settlement and improving overall efficiency.

Automating Loan Processing with Smart Contracts

- Streamlined Procedures

- Automated Approval: Smart contracts can automate the approval process for loans by verifying the borrower’s credentials and ensuring all conditions are met before disbursing funds.

- Instant Payments: Once conditions are fulfilled, smart contracts automatically release payments, eliminating delays and manual intervention in the loan disbursement process.

- Risk Mitigation

- Enhanced Accuracy: Automated processing reduces the risk of human error and ensures that all terms are consistently applied, improving the accuracy of loan processing.

- Fraud Prevention: Smart contracts help prevent fraud by ensuring that loan conditions are met before any funds are transferred, reducing the likelihood of unauthorized transactions.

Adapting Traditional Banking to Smart Contract Innovations

- Integration Challenges

- Legacy Systems: Traditional banks often operate with legacy systems that may not be compatible with blockchain technology. Integrating smart contracts requires updating or replacing existing infrastructure.

- Regulatory Compliance: Banks must navigate regulatory requirements and ensure that smart contracts comply with financial regulations, which may involve legal and compliance adjustments.

- Opportunities for Innovation

- New Business Models: Banks can leverage smart contracts to develop new financial products and services, such as decentralized finance (DeFi) offerings and automated financial management tools.

- Enhanced Customer Experience: By adopting smart contracts, banks can offer customers faster, more transparent, and efficient services, improving overall satisfaction and loyalty.

Smart contracts are poised to significantly impact traditional banking systems by enhancing financial transparency, automating loan processing, and driving innovation. While integrating these technologies presents challenges, the potential benefits include improved efficiency, reduced costs, and enhanced customer experiences. As banks adapt to these innovations, they have the opportunity to transform their operations and stay competitive in an evolving financial landscape.